Some facts on Earnings Announcement and Analyst Revision

Unless otherwise mentioned, the following statistics are based on all earnings event in CIQ (Captial IQ) since 2007.

Because we need timestamps at second level, events that have a zero time component in CIQ (e.g., 2001-01-01 00:00:00) are ignored.

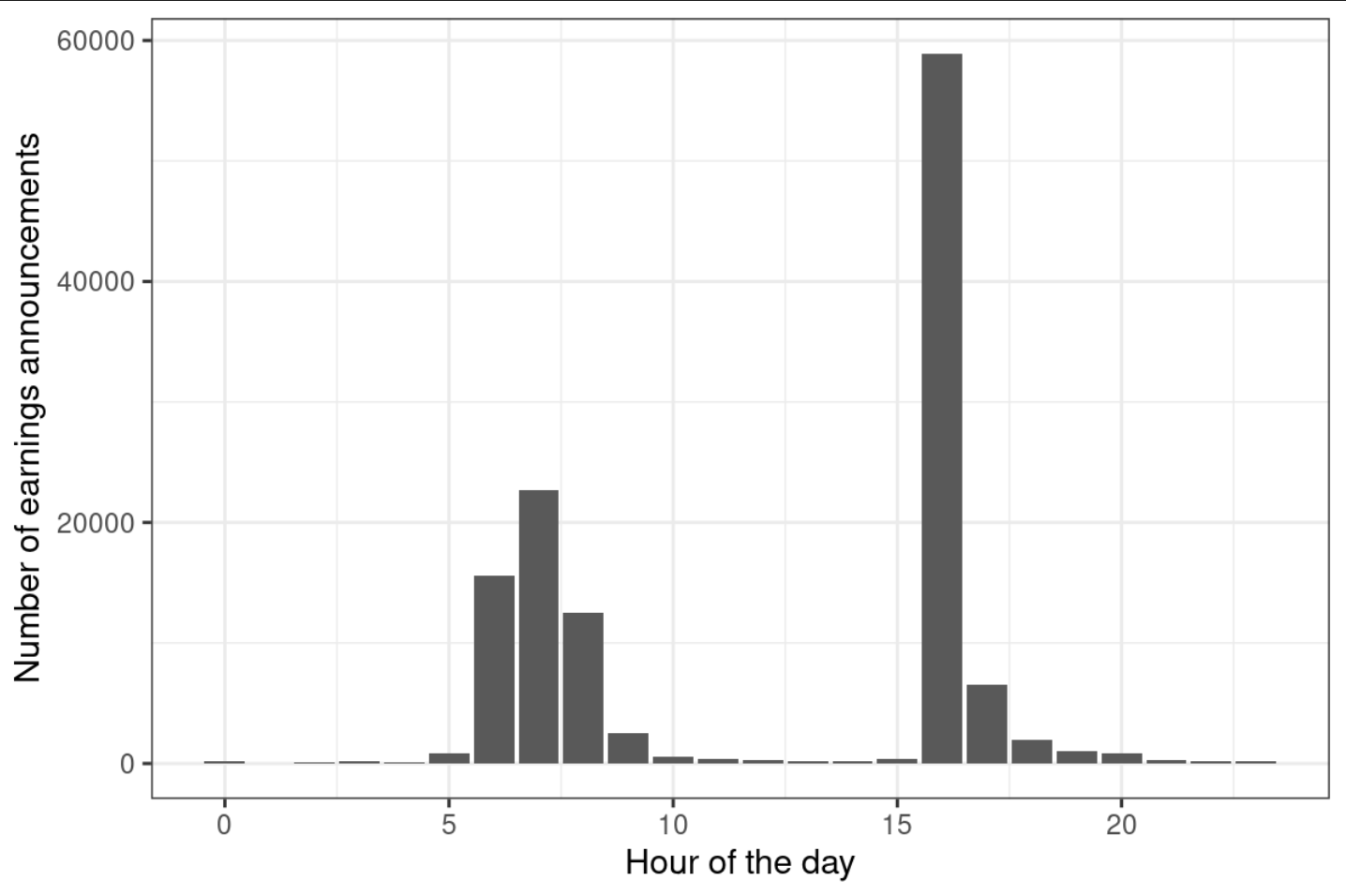

1 Time of Announcement

There’re two popular announcement time

- Before market open: 6 am to 9 am

- After close: 4 pm to 5 pm

10 means 10:00 to 10:59

2 Time of Calls

- Most calls are in the morning session (8 am to 11 am)

- Others are after market close (4 pm to 5 pm)

2.1 Lag of Calls

Calls are always behind the announcement. How much is the lag?

- 77.3% are on the same day

- 22.4% are on the next day

3 Determine day 0 in CAR

While calculating the post-announcement CAR(0,T), we need to determine which day is day 0 (i.e., the earnings call day). It turns out this is a trivial problem.

Appendix A of (Meursault et al., 2021) discusses this problem.

Using RDQ provided by CIQ as day zero of CAR is problematic: If the event is before market close, then RDQ as day zero is fine, but if the event is after the market close, then day zero should be the next trading day.

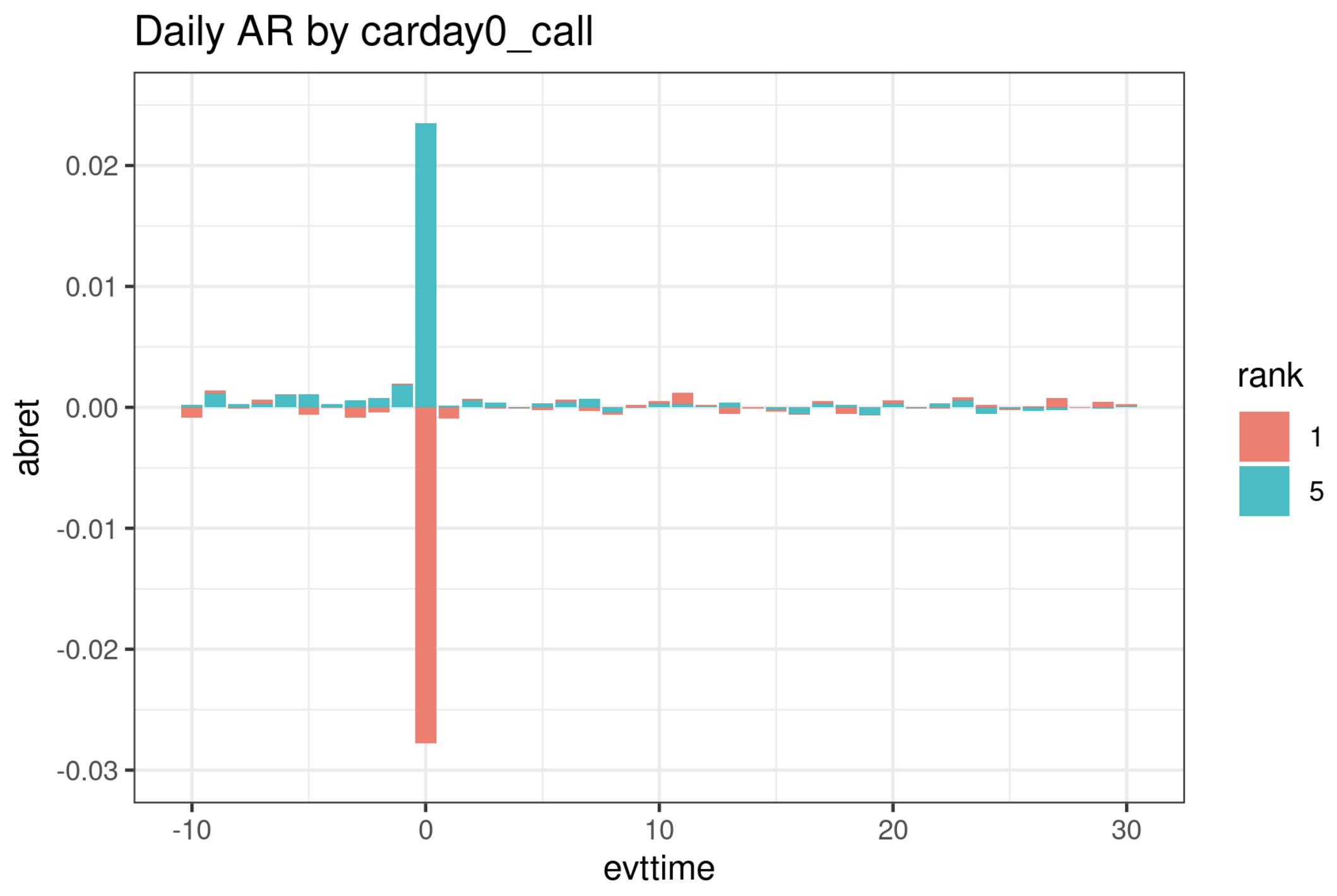

The following figure shows the daily AR when we treat RDQ as day 0. You see both day 0 and day 1 have large ARs.

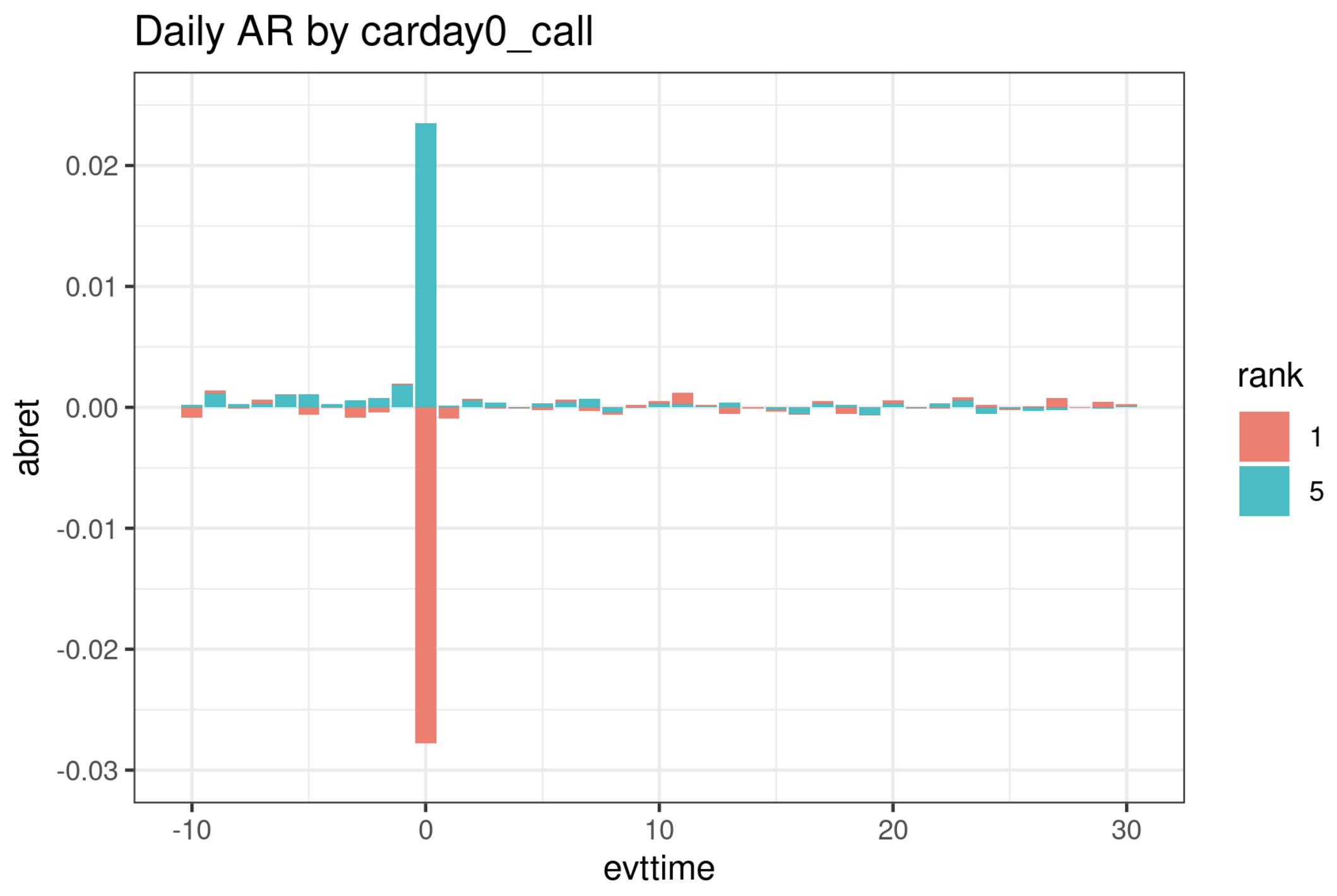

Now let’s use the adjusted event time by 1) improving the timestamps with RavenPack, and 2) applying the 3pm rule. See Appendix A of (Meursault et al., 2021) for details. As you can see, most of the AR is concentrated in day 0 now!

A potential concern is earnings calls. Since earnings calls is after the announcements, will such lag impact the AR distribution?

The answer is no. See the following figure: It’s almost identical to carday0_ann! The reason is that most announcement is after market close and the follow-up calls are on the same or next day. So after we apply the “3 pm rule,” the day 0 for announcement and call are identical.

Now we can safely use carday0_call without worrying about losing any AR!

4 Revision lag

We observe that

- most revisions are made in the first two days;

- the bump after day 75 is because of the approaching next earnings announcement.

5 References

- Meursault, V., Liang, P. J., Routledge, B. R., & Scanlon, M. M. (2021). PEAD.txt: Post-Earnings-Announcement Drift Using Text. Journal of Financial and Quantitative Analysis, 1–50. ^1